HURRY! This 1-Hour Training is Only Available Until Mon, July 21st

HURRY! Access Closes on Saturday, December 20th

HURRY! Access Closes on Saturday, December 20th

Join The 2026 LEAP Challenge

24 Trades. One Year. A Real Attempt to Double a $100,000 Portfolio Using LEAP Options.

Follow my trades, learn the method, and grow your own portfolio alongside me throughout 2026.

Small portfolio? This video teaches the exact framework I’d use if I had to start over with a tiny account

Everything You'll Get

Full Access to All 2026 LEAP Trades

See every position I take — entries, exits, sizing, and timing — so you can mirror the logic and learn the exact framework behind each decision.

Real-Time Trading Reports

Get clear, structured breakdowns of each trade as it happens, including why it was chosen, what I’m targeting, and how it fits into the overall plan.

Personal Voice-Note Updates

Receive direct voice messages from me inside the group with ongoing insights, mindset coaching, and updates on what I’m watching next.

Monthly Coaching & Support Calls

Join me live each month as I teach the method, answer questions, walk through trades, and help you apply the framework to your own portfolio.

Accountability to Scale Your Portfolio

Stay consistent and disciplined with a community built around the same mission — growing capital through controlled, rule-based LEAP trading.

Sunday, July 13th @ 12pm EST

(Recording will be available)

Henry's LEAPS Options Trader Meeting

Are You Ready?

With the 2025 Bull Market in full effect, your trading strategy needs to adapt or you'll miss out on the earnings you could make in 2025.

One of my favorite strategies for Bull Markets is LEAPS because it's a high-leverage strategy but also low risk - because you don't need margin calls or to own shares to use this strategy.

Join me for a 2-hour live webinar where I’ll be diving deep into how to implement LEAPS into your portfolio, as well as which stocks are best for LEAPS and why.

This is extremely important as I am sharing new information and analysis I won't be covering anywhere else plus some opportunities listed below. Read full information please.

IMPORTANT: This LIVE Zoom meeting is happening on Sun, July 13th @ 12PM EST. This meeting will only happen ONCE. If you can't make it, a recording will be provided.

📍 What You'll Get

LEAPS Options Masterclass: Learn everything about how this high-leverage & low-risk Options Strategy works & become an expert at using LEAPS

Stock Selection Masterclass: Learn the criteria I use to identify which stocks are best for LEAPS & which stocks are best for other Options strategies

List of Top 7 Stocks for LEAPS Options: I’ll reveal my personal list of 7 high-potential stocks with the potential to outperform, so you can get in early and make the most of the momentum.

🎁 Exclusive Offer for Attendees

As a thank you for joining, I’m offering a trial access to my Discord community where I share real-time updates, alerts, and support.

You’ll get to be a part of an active, insightful trading network where you can test-drive the strategies discussed in the session.

I will be running a special promotion for attendees to try several group trading sessions with me where we can interact, place trades and give you a trial feeling of my Discord community.

This will be for purchase at a special price.

IMPORTANT: This LIVE Zoom meeting is happening on Sat, Dec 7th @ 12PM EST. This meeting will only happen ONCE. If you can't make it, a recording will be provided.

For the Trader with a Small Portfolio...

Hey,

When you’re trading with a small account — maybe $500, maybe $5k — you don’t need risky YOLO plays to grow.

You need a system built to compound.

In this training, I’ll show you the 3 "Scaling Levers" that helped me grow from a few thousand to over $4M — without blowing up along the way.

You’ll learn how to size positions smartly as your account grows, use risk-adjusted strategies like spreads and income trades to multiply safely, and apply a simple 3-bucket capital system to stay consistent no matter what the market’s doing.

Most importantly, I’ll walk you through the mindset shift that helped me stop chasing and start building real momentum — even with a small starting balance.

This training could be life-changing & for a limited time, it's available for just $79.

Here's Everything You'll Learn In This 1-Hour Training

The exact moves I’d make if I had to start from scratch with just $500 — even if you’re brand new or burned by alerts.

Why most traders stay stuck under $10k — and the 3 simple tweaks that helped me scale safely to six figures (and beyond).

The “Fixed vs % Risk” shift that changes everything once your account starts growing (most traders get this wrong).

What to do when you’re under $50k and overtrading… or over $50k and playing too small (and how to fix both instantly).

My favorite risk-adjusted setups for scaling fast — without gambling or blowing up your account (yes, even with a tiny balance).

The secret to using spreads, CSPs, and covered calls to create smooth, compounding growth — even in a choppy market.

Why capital allocation (not just stock picking) is the real secret behind consistent growth — and how to set up your “3-bucket” system like a fund manager.

The mindset shift that helped me scale from $5k to $700k — and how to finally trade like a pro (instead of an emotional mess).

Stuck between $10k and $100k? You’ll get the exact roadmap I used to confidently cross that gap — without second-guessing every trade.

For serious traders: Get private 1-on-1 messaging with Henry to map out your plan from medium to BIG. (Get details after purchase)

Let me be upfront before we go any further.

This is not a course.

It’s not theory.

It’s not a replay of old wins.

This is a LIVE, 1-Year, LEAP-Only Challenge...

Where I attempt to grow a brand-new $100,000 account into $200,000...

Using a very specific options framework that most traders either misunderstand or misuse.

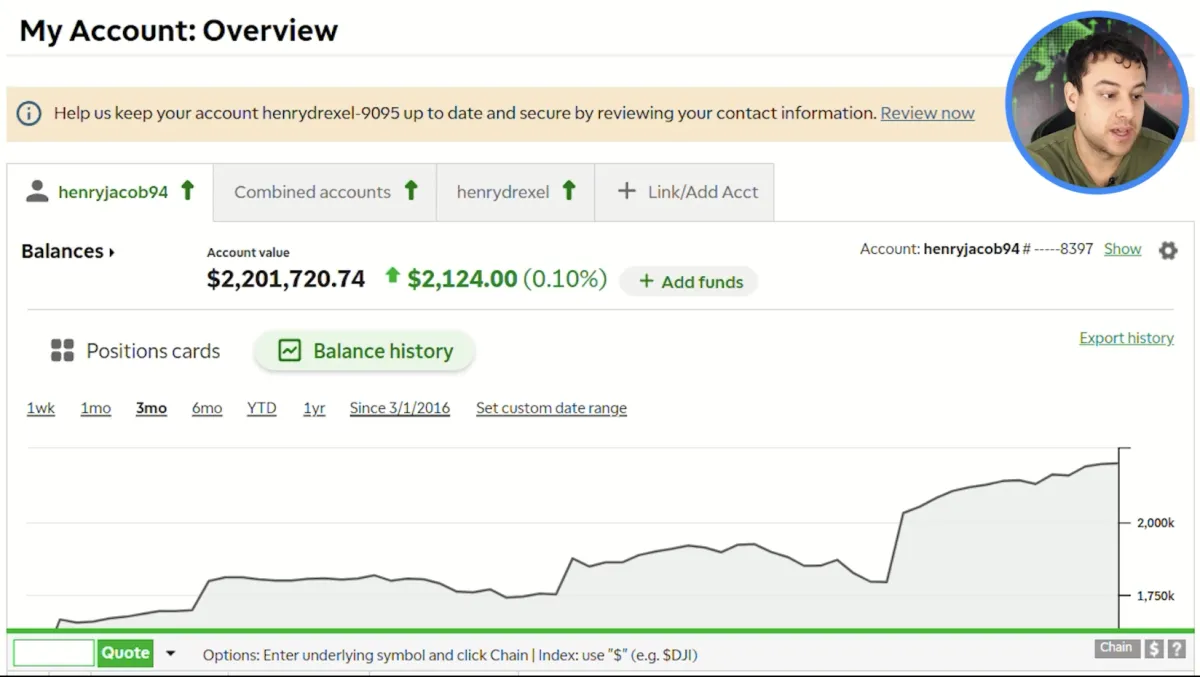

I’ve done this before — at a much larger scale.

This time, I’m doing it cleaner, simpler, and fully documented.

Why This Exists...

Read This Carefully

Back in 2021, I turned $100,000 into roughly $700,000...

That wasn’t luck.

It wasn’t perfect timing.

And it definitely wasn’t random.

But here’s the reality most people don’t want to hear:

That kind of outcome cannot be promised, repeated on demand, or responsibly marketed as an expectation.

So I’m not doing that.

Instead, I’m running something much harder — and much more honest.

A controlled, rule-based attempt to double capital using long-dated LEAP options, with:

Limited trades

Defined risk

Minimal management

Zero cherry-picking

No hindsight

Everything happens live, in real time, with real money.

*I will be making trades that are $1,000 to $3,000 in size.

What Makes This Different

Than Everything Else You’ve Seen

Most options communities fall into

one of two traps:

1 - Too much activity

Trades every day. Weekly options. Constant alerts. Emotional burnout.

2 - Too much theory

Charts, opinions, models — but no actual execution you can follow.

This challenge sits in a third category.

It’s about capital deployment, not entertainment.

24 trades.

That’s it.

No more. No less.

And that number matters more than you think.

Why Only 24 Trades?

Because constraint forces discipline.

Each trade has to matter.

Each trade has to be justified.

And most importantly — each trade must be something you’re comfortable holding for months, not days.

This alone changes how most people think about options.

Limited trades

Defined risk

Minimal management

Zero cherry-picking

No hindsight

Everything happens live, in real time, with real money.

*I will be making trades that are $1,000-$3,000 in size.

The Strategy

What I Will and Won’t Touch

I Will Use:

Deep in-the-money LEAP call options

Expirations 9 to 24 months out

Companies with strong fundamentals and real tailwinds

Position sizing that respects drawdowns

I Will Not Use:

Weekly options

Earnings gambles

“Gamma plays”

Constant rolling

Emotional management

Once a trade is entered, the goal is not to babysit it.

Most trades are designed to simply sit and do their job.

This is why LEAPs are so powerful when used properly — and why most traders fail with them.

What You’ll See

That Most People Never Showw

When you join, you won’t just see trades, You’ll see:

Exactly when capital is deployed

How much capital is deployed per position

Why certain opportunities are passed on

How drawdowns are handled psychologically

When not to do anything

You’ll also see something that’s rarely shown publicly:

A running account balance, updated as trades

close.

Wins. Losses. Flat trades. All of it.

No smoothing.

No filtering.

No “best trades only.”

The Math

This Is Where People Get It Wrong

Let’s be realistic.

Out of 24 trades:

I’m not expecting perfection

I don’t need every trade to work.

I don’t need heroic wins

My internal goal is to win roughly 18–20 trades.

Checkout the video for more details I breakdown the math for you as well as my goal.

Everything You'll Get

Inside the 2026 LEAP Challenge

Full Access to All 2026 LEAP Trades

See every position I take — entries, exits, sizing, and timing — so you can mirror the logic and learn the exact framework behind each decision.

Real-Time Trading Reports

Get clear, structured breakdowns of each trade as it happens, including why it was chosen, what I’m targeting, and how it fits into the overall plan.

Personal Voice-Note Updates

Receive direct voice messages from me inside the group with ongoing insights, mindset coaching, and updates on what I’m watching next.

Monthly Coaching & Support Calls

Join me live each month as I teach the method, answer questions, walk through trades, and help you apply the framework to your own portfolio.

Accountability to Scale Your Portfolio

Stay consistent and disciplined with a community built around the same mission — growing capital through controlled, rule-based LEAP trading.

Join the 2026 LEAP Challenge — $497 One-Time

Access closes on Saturday, December 20th

3,000+

Traders Helped

1000+

Hours of Learning Time Saved

2000+

Profitable Students

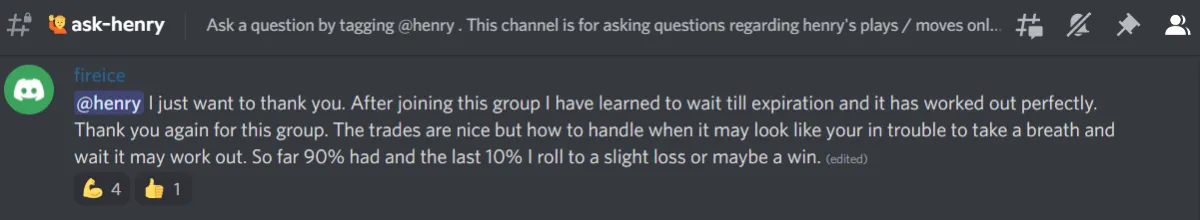

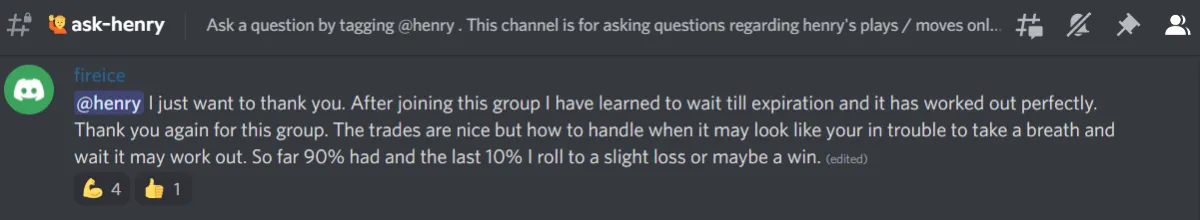

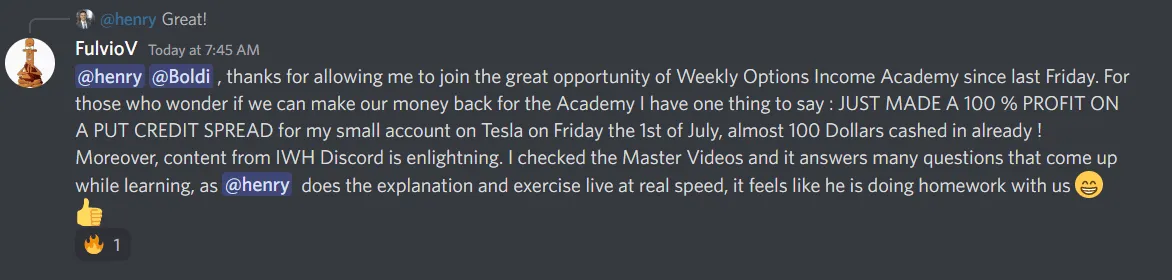

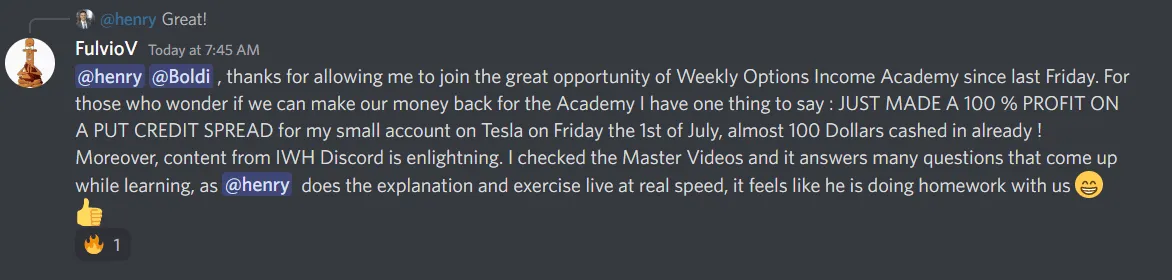

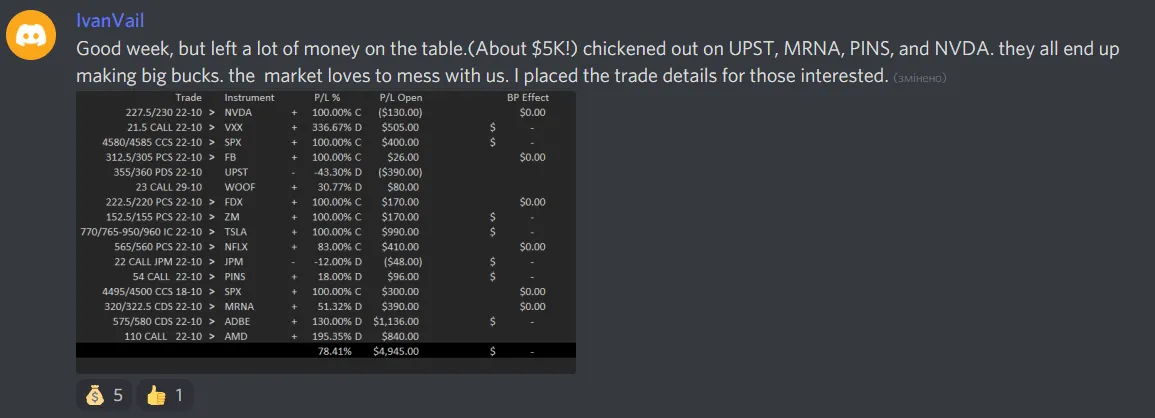

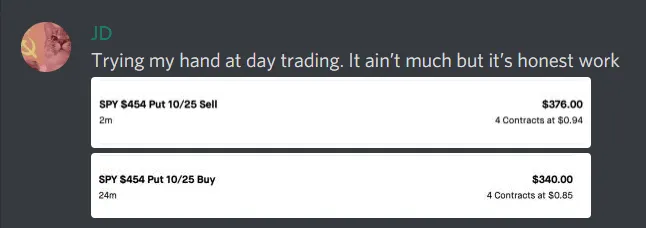

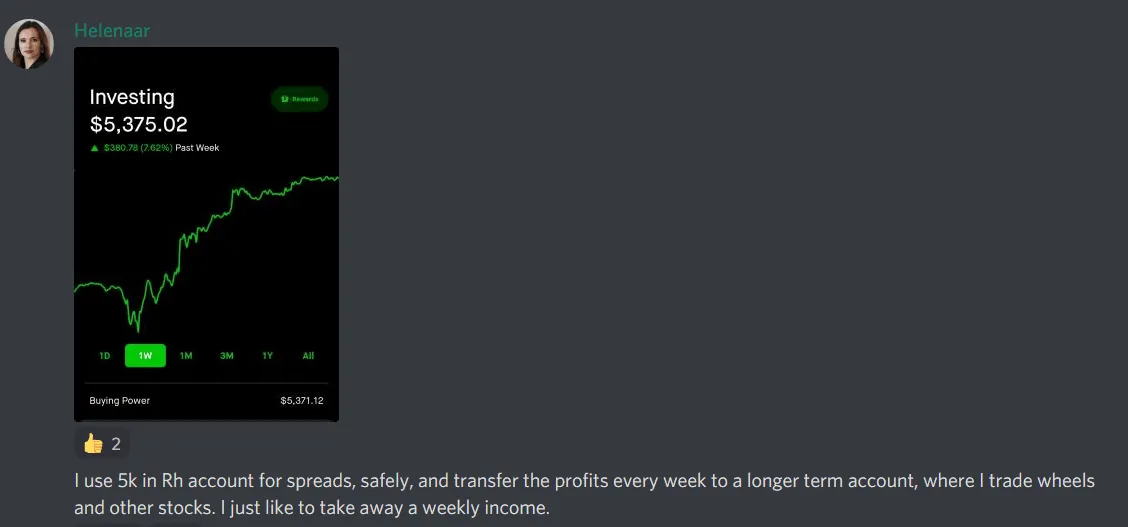

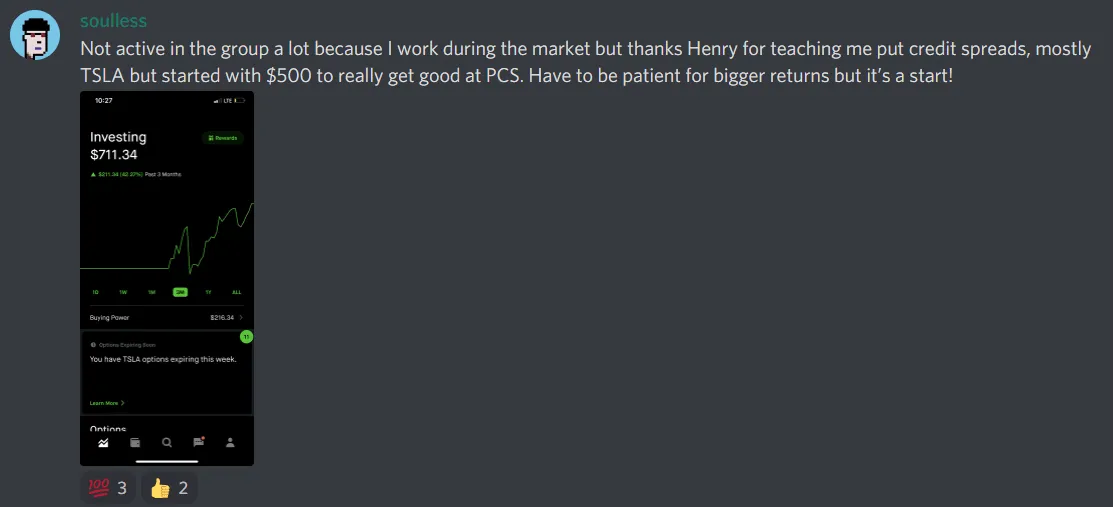

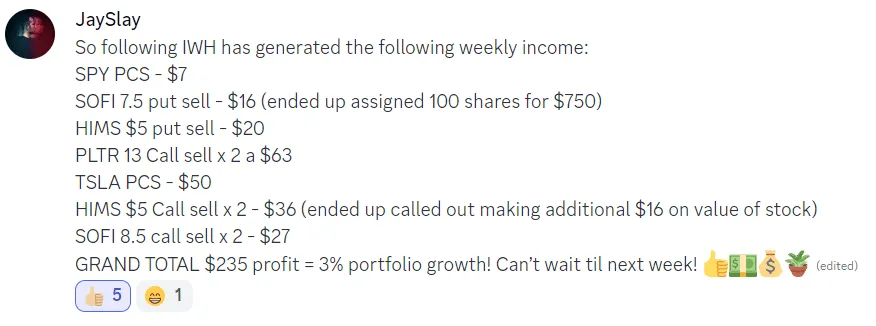

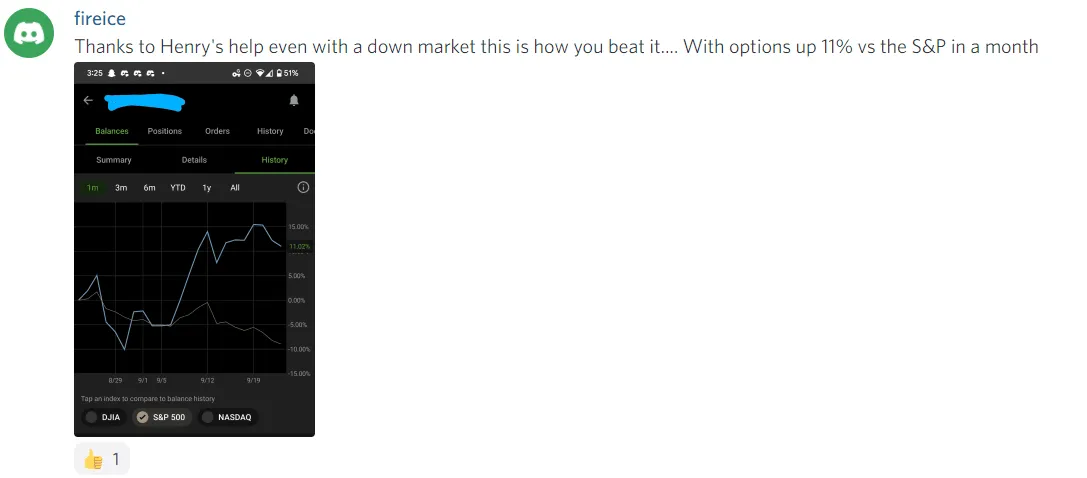

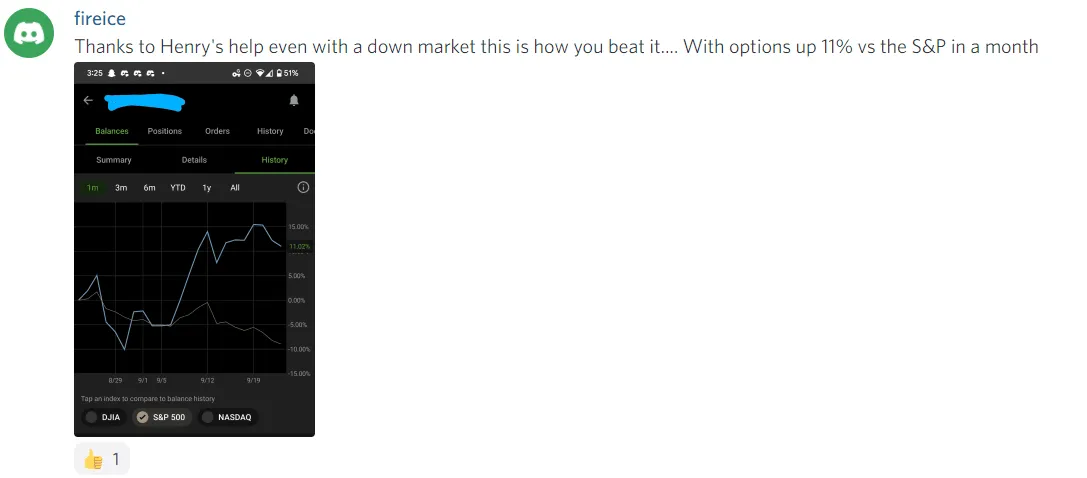

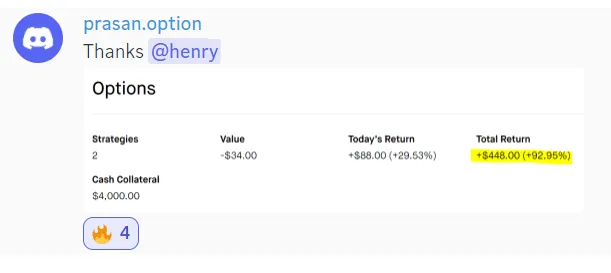

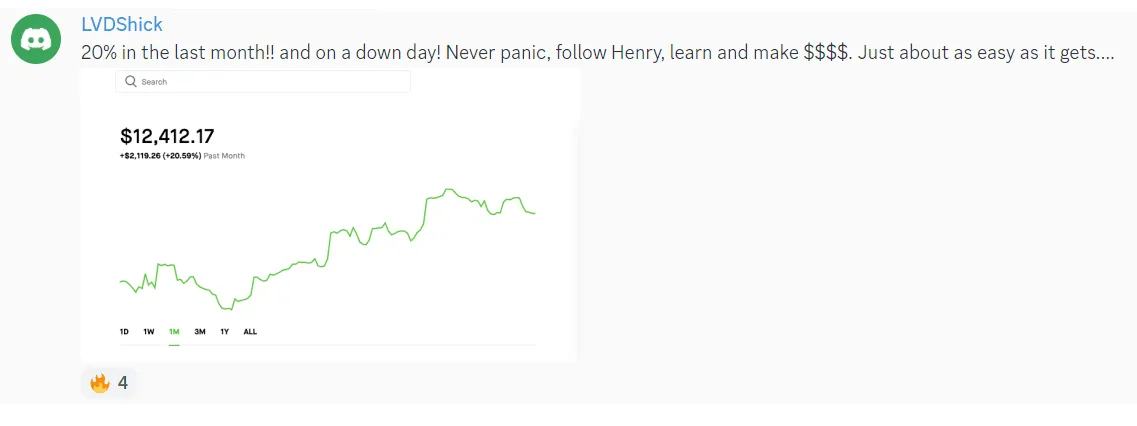

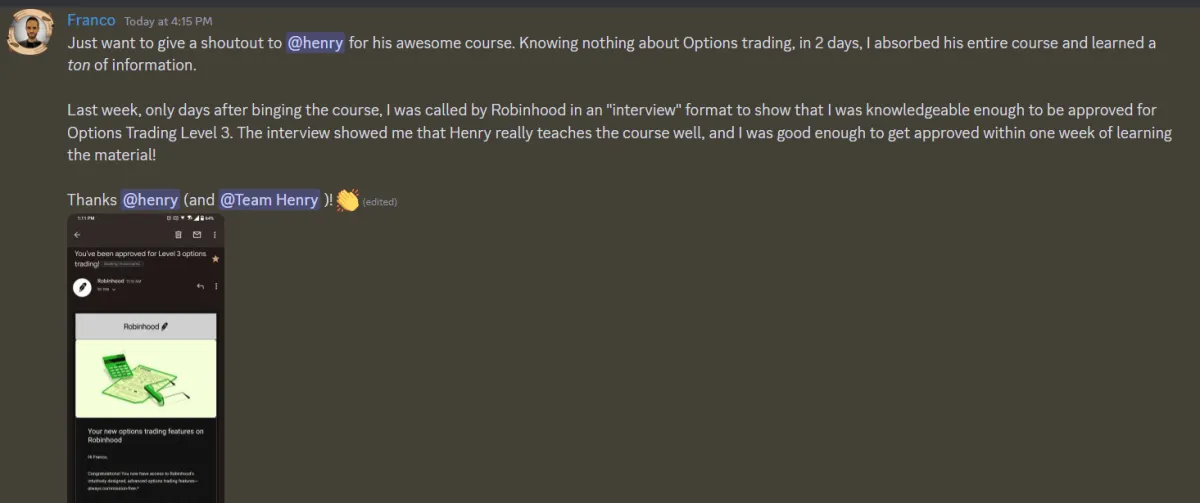

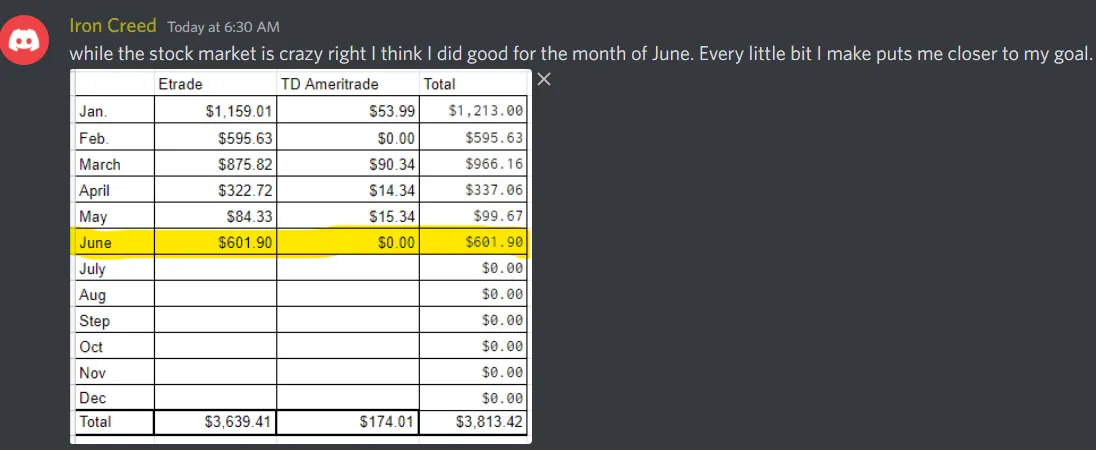

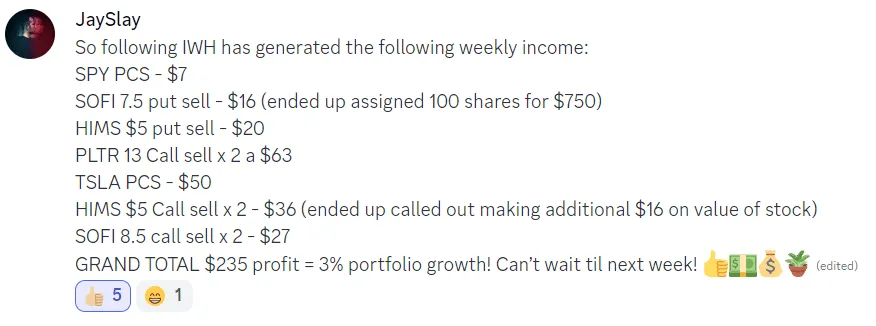

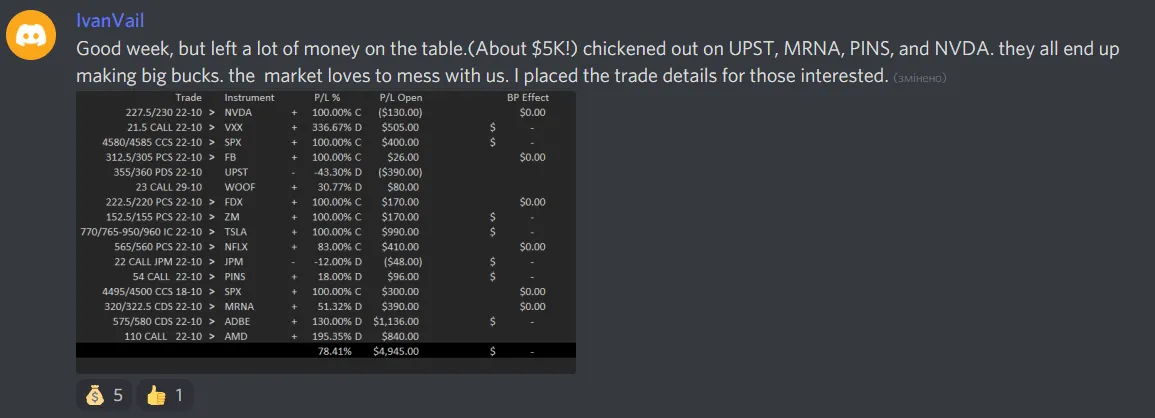

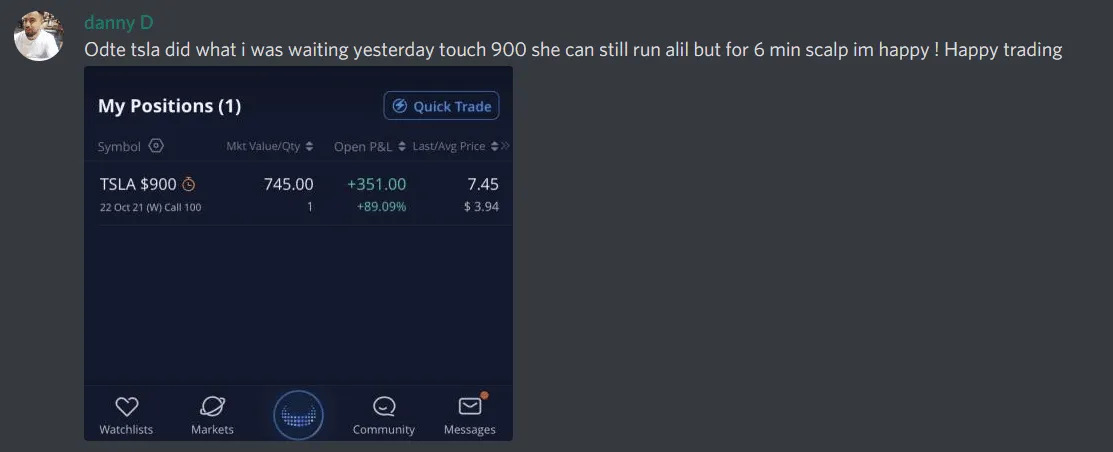

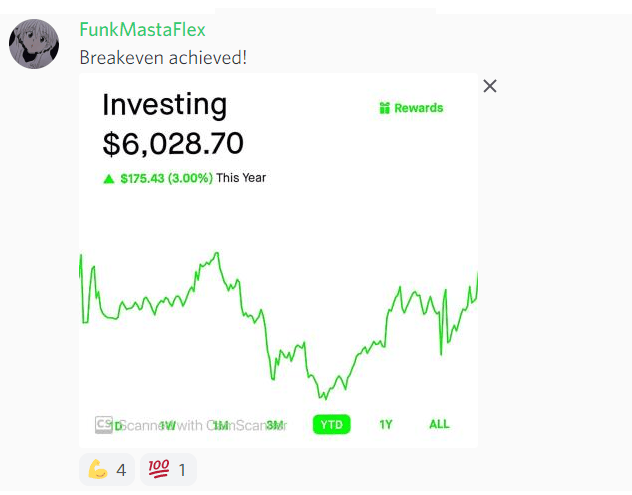

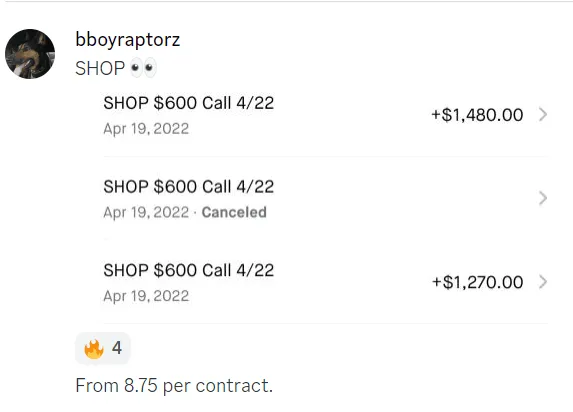

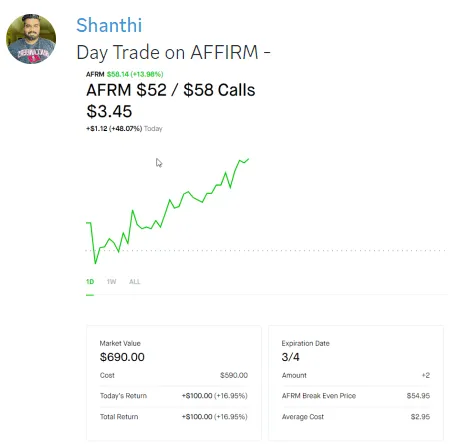

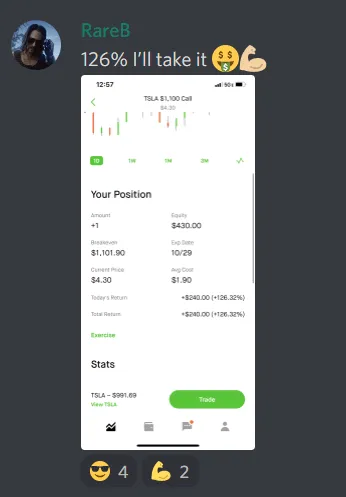

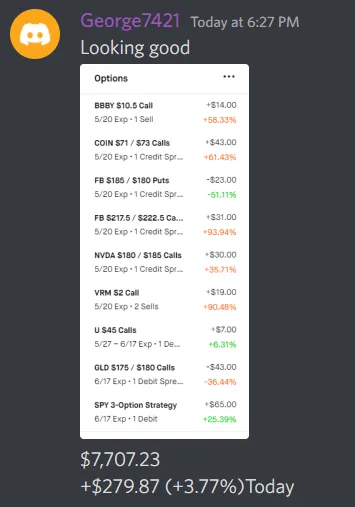

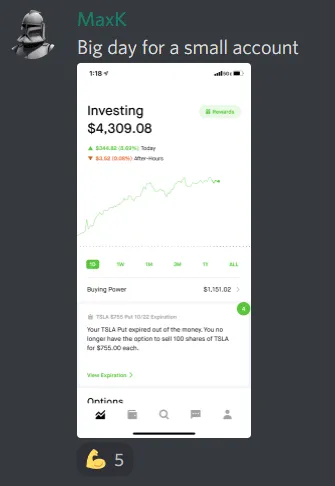

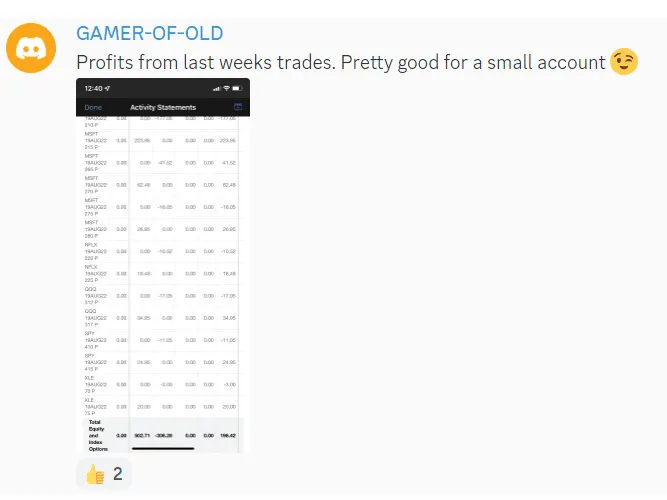

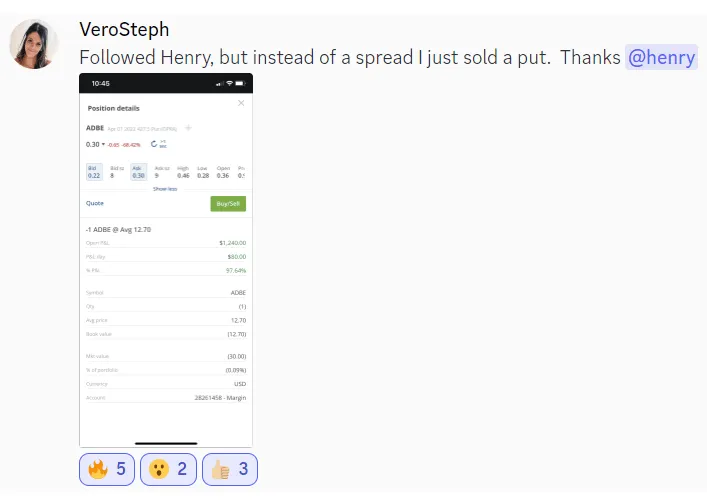

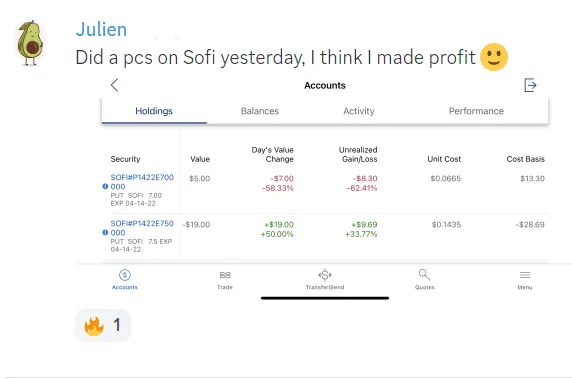

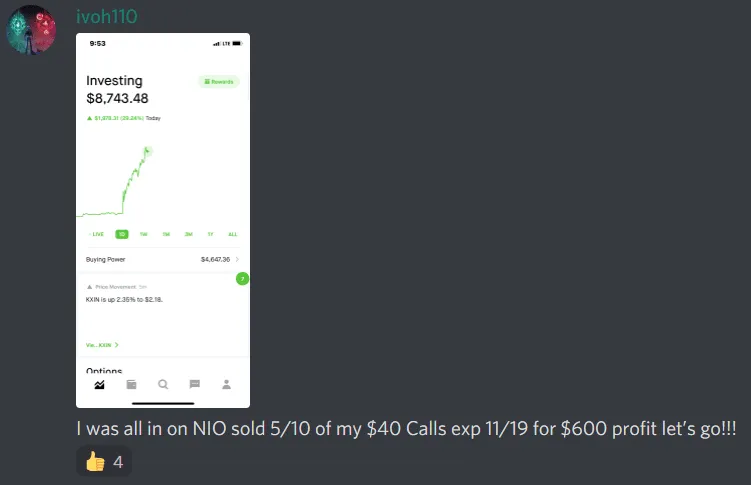

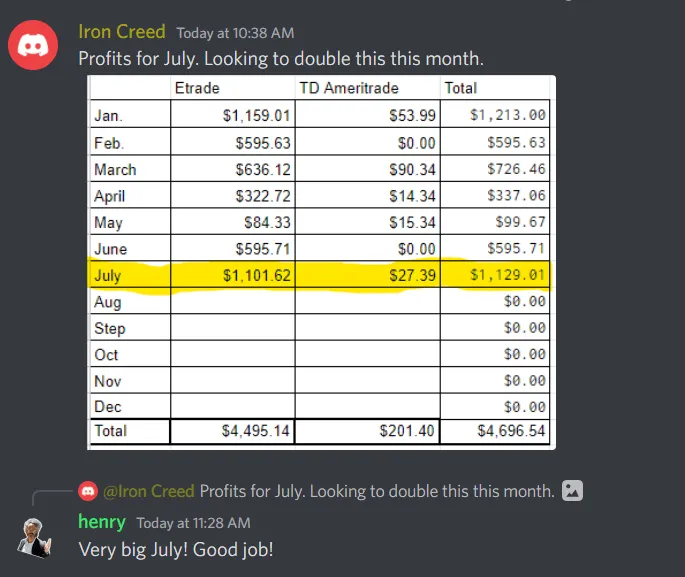

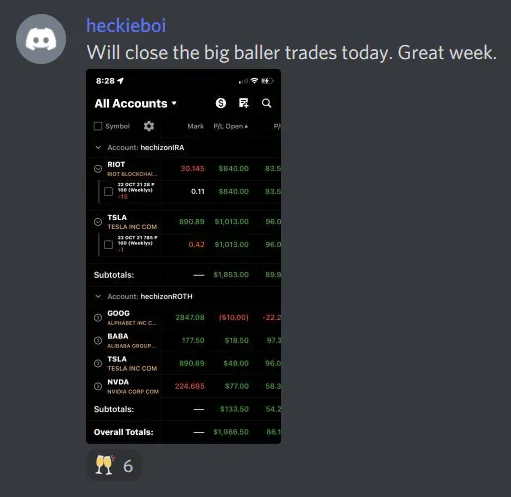

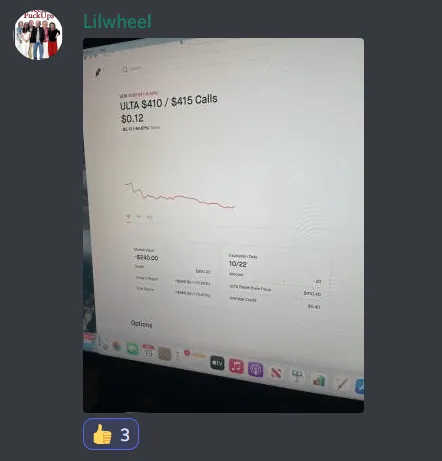

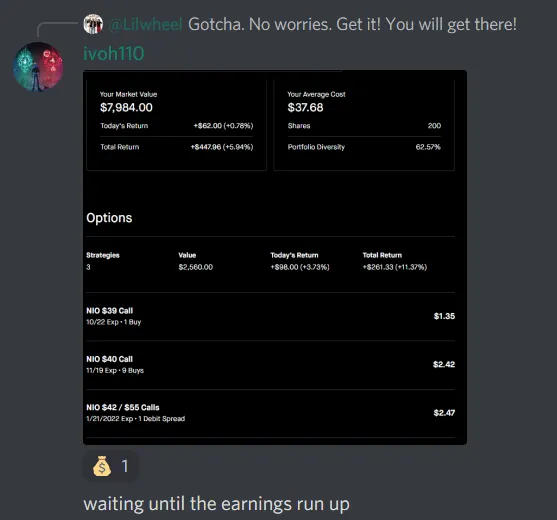

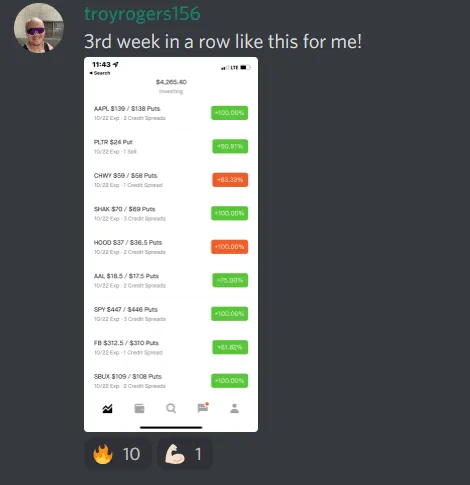

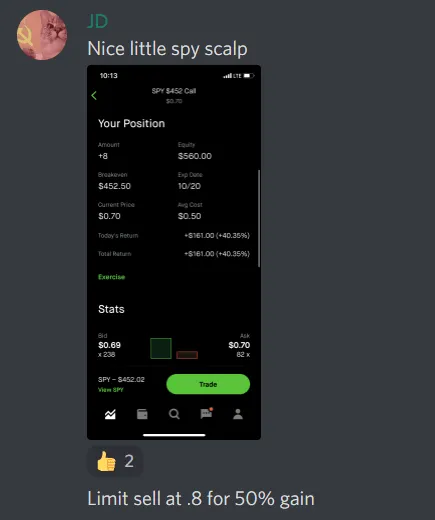

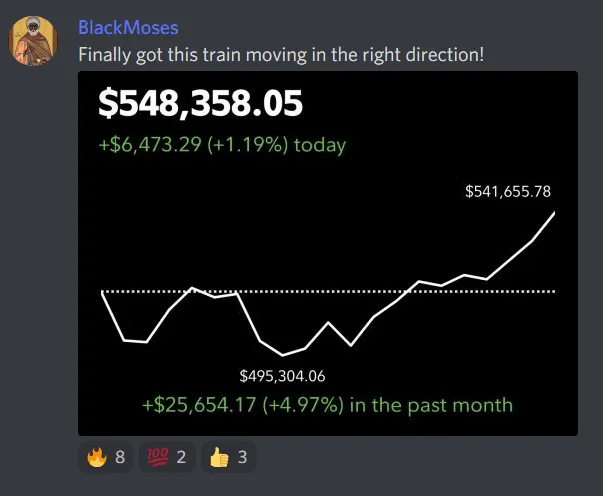

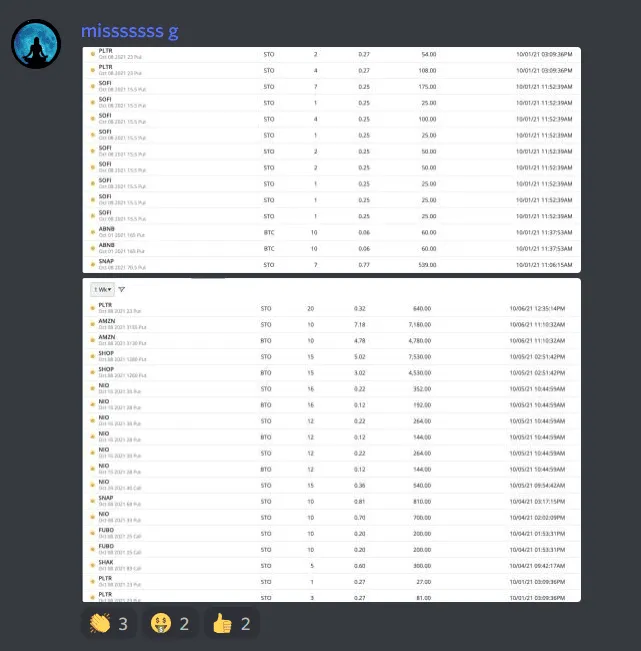

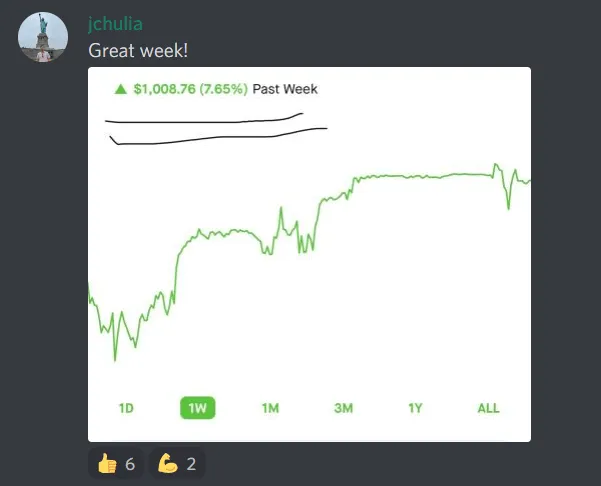

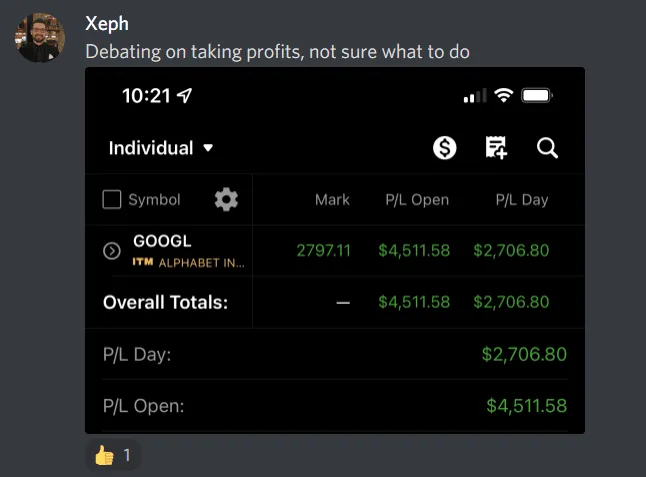

Listen to What Past Students have to say

Join the 2026 LEAP Challenge — $497 One-Time

Access closes on Saturday, December 20th

Earnings Disclaimer: Be aware that Trading stocks, futures, stock options, and futures options involves a substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. INFORMATION IS FOR GENERAL EDUCATIONAL AND RESEARCH PURPOSES AND SHOULD NOT BE CONSTRUED AS INDIVIDUAL INVESTMENT ADVICE.

© 2025 Invest with Henry, LLC. All Rights Reserved. 1710 Tracey Street, Philadelphia, PA, 19115

Terms of Service | Privacy Policy | Earnings Claims Disclosure